Customer lifetime value (CLV) is the measure of the total income a business can expect to bring in from a typical customer for as long as that person or account remains a client. It can be estimated with some basic calculations or more complex ones taking into account multiple factors.

Why Is Customer Lifetime Value important to Businesses? Why Does It Matter?

By understanding the different parts of your CLV, you can test different strategies to find out what works best with your customers. CLV can be an important financial metric for small businesses thanks to its simplicity.

The main reasons businesses should care about CLV are the following:

- Once you start tracking your customers' CLV, you can use better tactics and adapt to their spending tendencies to reduce costs and maximize profit.

- You get to know better what type of customers your business brings in so that you can plan better your marketing campaigns.

- By forecasting what your customers want or need, you can anticipate your expenses and reduce even more costs.

Advantages of CLV

- Retaining customers for a longer time.

- Improve customer loyalty.

- Increased profits and reduction of overall costs.

- A bigger number of repeated sales or returning customers.

CLV in Incomaker

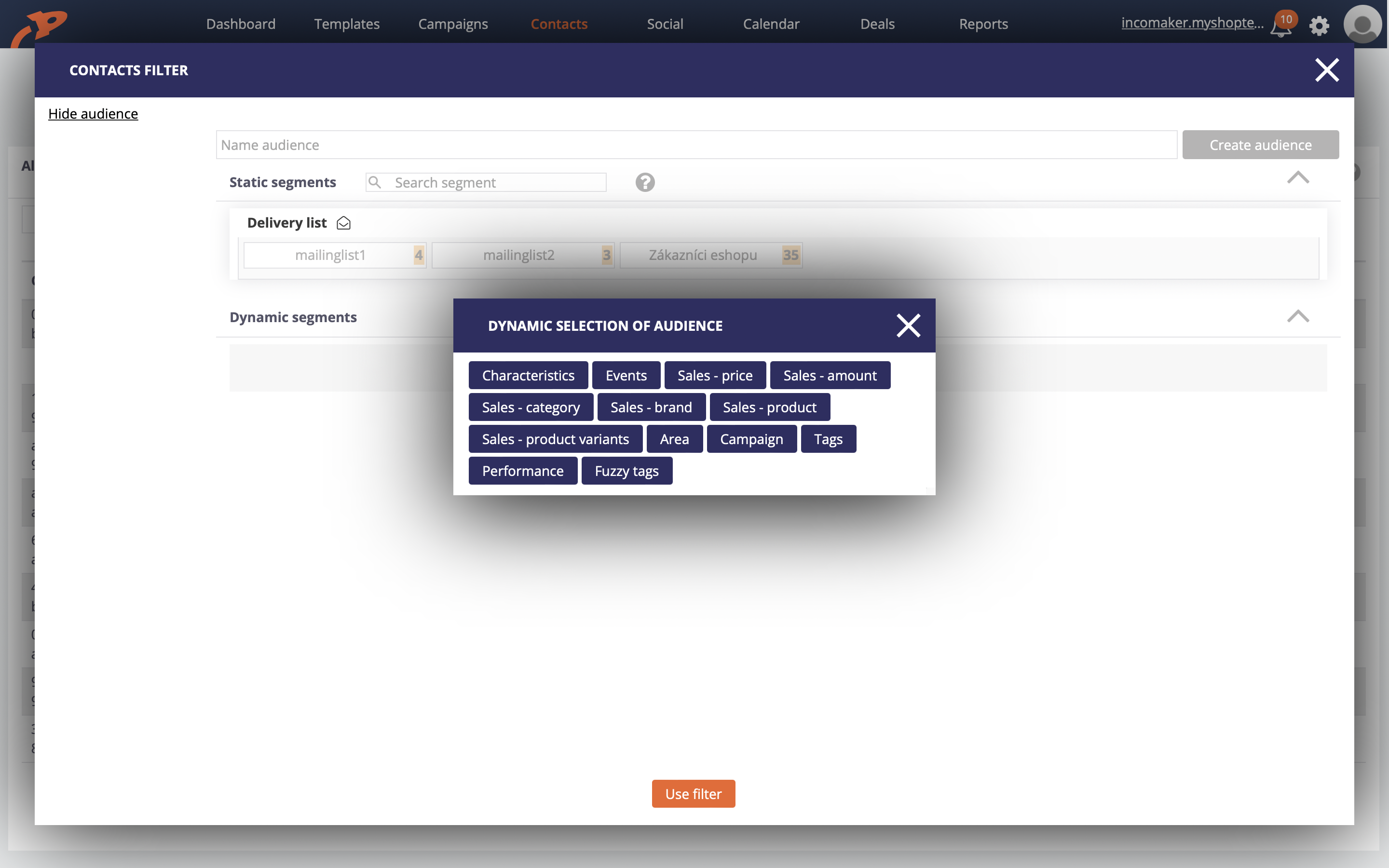

Incomaker works with CLV as one of the metrics. Incomaker calculates CLV automatically from user data Incomaker gets from e-shops. Incomaker shows it in reports, and mainly, it allows you to segment and filter your contacts depending on CLV and set up automated campaigns driven by it.

E.g., you can set up an automated campaign addressing customers with the highest CLV and send them rewards, etc.